[ad_1]

Executives at Permian Resources Corp., Midland, have raised 2024 production guidance by 2% and say acquisitions recently completed and signed should add another 1% to output.

During first-quarter 2024, Permian Resources produced nearly 152,000 b/d of crude oil and more than 319,000 boe/d of total average output. Those figures topped the forecasts co-chief executive officers Will Hickey and James Walter provided in late February thanks to better well productivity and the faster-than-expected integration of Earthstone Energy Inc. operations.

Permian Resoures’ leaders have set the company’s new oil and total production guidance to about 150,000 b/d and 320,000 boe/d. That number will increase more thanks to $270 million worth of bolt-on and grassroots acquisitions covering about 11,200 net acres. One bolt-on with an undisclosed buyer closed during the first quarter while another is expected to be completed by end-June.

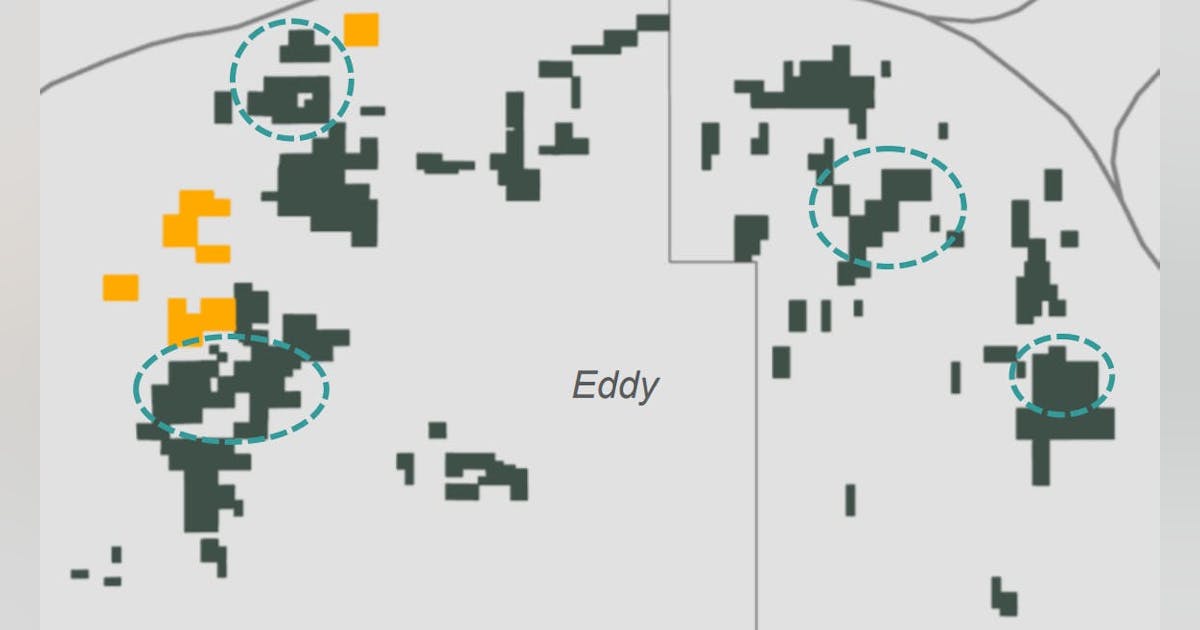

Both deals are for acreage in Eddy County, New Mexico, that sits adjacent to Permian Resources’ Parkway operations. The company plans to start developing 2-mile locations there in this year’s second half. Those assets as well as roughly 150 acquired leasing/working interest acquisitions will call for about $50 million of capital spending this year—about 10% of Permian Resources’ first-quarter capex total.

Permian Resources produced a first-quarter net profit (excluding noncontrolling interests) of nearly $147 million, an increase of 44% from the same period of 2023. Operating revenues more than doubled to $1.24 billion and operating income surged to $469 million from $236 million.

Shares of Permian Resources (Ticker: PR) were down about 3% to $17 in afternoon trading May 8. They are, however, still up more than 25% over the past 6 months, a climb that has grown the company’s market capitalization to more than $13 billion.

[ad_2]

Source link